Way back when, it was hard to find a life agent who didn't have his or her own DI policy. After all, DI was presented as an integral part of nearly every client's insurance plan. They were thoroughly versed, trained, and believed in the importance of the coverage. They wouldn't be caught Manulife 乐活计划 without it.

As agents and brokers, we can offer to round out each employee's family benefit program with life insurance, dental coverage, disability income protection, and perhaps add an IRA---and likely still save the employee money. The employee has financial assistance from the federal government and from the employer. As has been said above we wish to be creative helpful compliant and design well to fit Manulife Vitality Plan each client's needs and best interests.

Stay cheerful and friendly. If you make yourself positively useful and visible, you may be able to redefine yourself as a leader and step into another job. Either way, the exercise will get you thinking about your full range of skills and abilities that can help you move forward beyond an apparent dead-end.

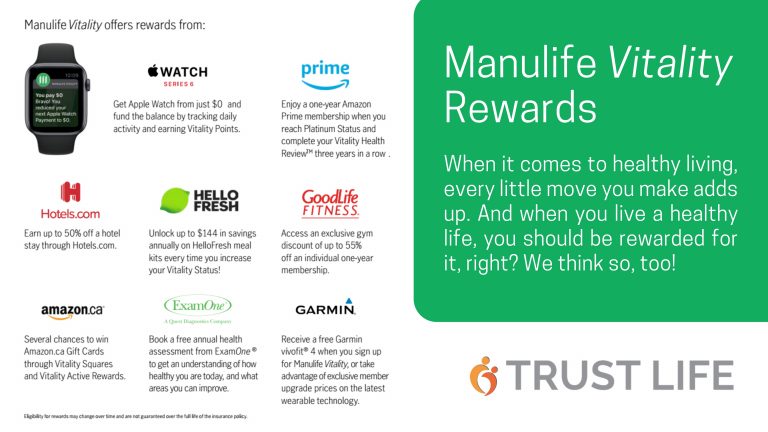

A Manulife Vitality health program insurance program is a service of the insurance companies that keeps your ensured against any serious illness like cancer. If, unfortunately, you happen to suffer from this serious disease ever in your life, you would not be worried about the cost of treatment as you can get the sum for treatment. As far as success of treatment is concerned, it is not sure, however, your family gets a huge sum of money if you happen to die in the process of your treatment.

There are various "types" of travel insurance. I am not talking about baggage insurance, or trip cancellation insurance, I am talking about what could happen if something happened to you. Although the other items are "important" as there is a financial interest at stake if something happened to your stuff, or your vacation, but what if something happened to you? Have you ever thought how much that would cost? One thing I can guarantee, it would cost more than the replacement cost of your belongings.

In the end, the situation is like this. The child is out of the house and no longer dependent on you. You don't have any debt. You have enough money to live off of, and pay for your funeral (which now costs thousands of dollars because the DEATH INDUSTRY has found new ways to make money by having people spend more honor and money on a person after they die then they did while that person was alive). So... at this point, what do you need insurance for? Exactly... absolutely nothing! So why would you buy Whole Life (a.k.a. DEATH) Insurance? The idea of a 179 year old person with grown children who don't depend on him/her still paying insurance premiums is asinine to say the least.

But it's not all about the cash value rate of return. What about the rate of return on the death benefit? Like I mentioned earlier, this issue is far too complex to cover all the points here!